Akron Community Foundation is audited on an annual basis by Maloney + Novotny LLC. Previous audits were conducted by Sikich.

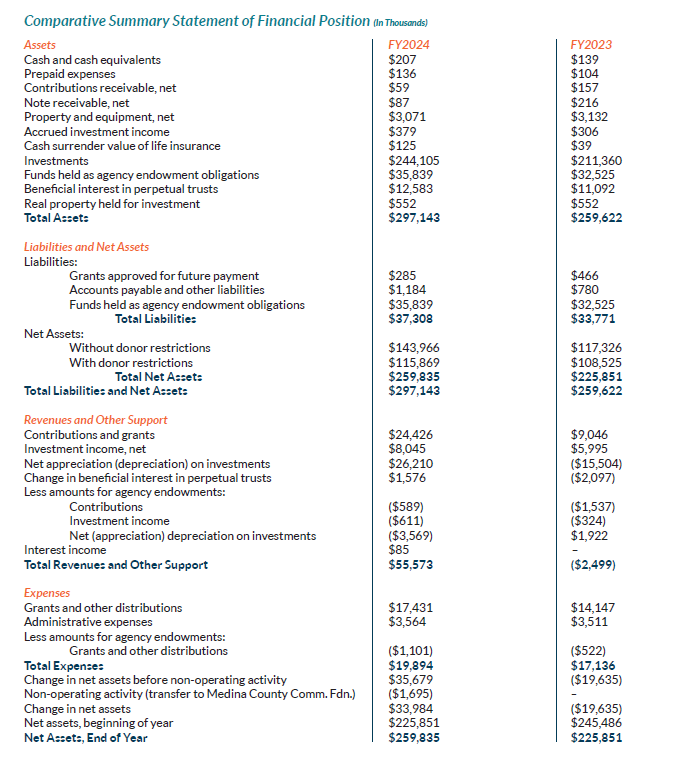

2024 Akron Community Foundation Financial Statements

2023 Akron Community Foundation Financial Statements

2022 Akron Community Foundation Financial Statements

2021 Akron Community Foundation Financial Statements

2020 Akron Community Foundation Financial Statements

2019 Akron Community Foundation Financial Statements

2018 Akron Community Foundation Financial Statements

2017 Akron Community Foundation Financial Statements

2016 Akron Community Foundation Financial Statements

2015 Akron Community Foundation Financial Statements

2014 Akron Community Foundation Financial Statements