Whether it's a gift of stock you plan to transfer in the near future or a bequest you leave in your will, a planned gift is any charitable gift that you wouldn't be able to give through a check or cash today.

Create Your Legacy – Support the Charities You Love

The future is unpredictable – your legacy shouldn't be. Together, with your advisors, we can help you navigate your charitable giving options and determine which gifts work best for you.

Planned giving may be right for you if you're willing to consider charitable plans that:

- Take place upon your death

- Ensure your family and friends are cared for first

- Guarantee you a lifetime stream of income

What is Planned Giving?

A planned gift is any major gift made during your lifetime or after death as part of your overall financial and estate planning. Often referred to as charitable gift planning or legacy giving, planned giving enables you to support nonprofits with larger charitable gifts than you could make from ordinary income.

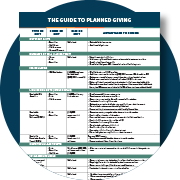

Types of Gifts

An outright gift is a simple way to support your favorite causes by contributing to or establishing your own charitable fund at Akron Community Foundation. Gifts are tax deductible and can be made with appreciated securities, real estate, personal property or other assets.

With thoughtful planning, you can leave a meaningful legacy to your favorite charities through your will or trust. Your gift can support a beloved charity, augment your current giving, or even be used to establish an endowment fund at Akron Community Foundation.

If you are 70 ½ or older, a qualified charitable distribution to Akron Community Foundation from your IRA can be an excellent way for you to make a charitable gift. By sending the funds directly to charity, your benefit is two-fold: You can avoid paying the usual taxes while also satisfying your required minimum distributions. You can even use your RMD to create your own charitable fund, including a designated fund or scholarship fund. (Note: The IRS does not permit qualified charitable distributions to donor-advised funds.) Thanks to recent legislation, donors may also make a one-time transfer to a charitable gift annuity or charitable remainder trust.

A charitable gift annuity enables you to make a gift to your favorite charity and receive fixed payments for life in return. The payments may begin immediately or can be deferred to a future date of your choice. The annuity arrangement terminates upon your death, at which point the designated charity will receive the remaining funds. Charitable gift annuities cannot accept additional contributions once they have been established, but it is simple to set up additional annuities if needed.

A charitable remainder unitrust (CRUT) is a tax-exempt irrevocable trust designed to reduce your taxable income. It accomplishes this by disbursing income to the beneficiaries of the trust for a specified time period and then donating the remainder to the designated charity. This is a "split interest" giving vehicle that allows you to make additional contributions, be eligible for a partial tax deduction, and donate the remaining assets.

Annuity Trusts

A charitable remainder annuity trust (CRAT) is a type of gift transaction in which you contribute assets to a charitable trust. The trust pays an annuity designed to leave a substantial portion of the funds to charity upon termination of the annuity. Unlike CRUTs, you cannot make additional contributions after the trust is formed.

A charitable lead trust is an irrevocable trust designed to provide financial support to one or more charities for a set amount of time. After that period has expired, the balance of the trust is then paid out to the beneficiary. This results in a reduction of taxes owed by the beneficiary upon inheritance of the remaining balance. It also provides other potential tax benefits, including an income tax deduction for charitable gifts and savings on both estate and gift taxes.

Gifting your life insurance policy is a simple and impactful way to support your favorite causes and charities. If your life insurance policy is no longer needed or will no longer benefit your survivors, consider using it to establish or grow your charitable fund at Akron Community Foundation, which will continue giving back in your name forever.

You Can Make a Legacy Gift

All Gifts Make a Difference

You don't have to be extraordinarily wealthy to make a planned charitable gift. Even a small contribution can have a large impact over time.

You Have Options

You don't have to choose between leaving a gift to your family OR charity. You can do both!

It's Easy! We Can Help

A simple designation to Akron Community Foundation can bring incredible support to the charities you love.

FAQs

Talking to your advisor about your estate plan is the best place to start. They will help you evaluate your situation and determine which assets are most advantageous to leave to family and which would be better left to charity. The beauty of planned giving is that most people can leave a significant gift to charity, whether it's through a gift while they're living or one that benefits the causes they care about after they're gone.

Bequests, or gifts left to charity through a will, are one of the most common types of planned gifts. Qualified charitable distributions from an IRA are also a popular giving tool for donors age 70 ½ or above. For those who would like to make a gift to charity while still generating a stream of income, a charitable gift annuity may make sense. It's important to talk to your advisor about the best gifts for your unique situation.

Many people think of writing a check when making a charitable gift, but gifts of appreciated assets, life insurance, real estate and more can also be an excellent way to make an impact on the causes you care about. Not all nonprofits are able to accept complex gifts, but Akron Community Foundation can accept a wide variety of assets to establish or contribute to your charitable fund.

If you haven't yet let us know about your bequest plans, please contact Laura Lederer so we can include you in our legacy society, the Edwin C. Shaw Society.

We encourage you to contact Laura Lederer, vice president and chief development officer. We would be happy to meet with you and your advisor to discuss planned giving opportunities that may be right for you.