Amplify Your Impact With a Gift of Life Insurance

It was a light-bulb moment the first time CBIZ Managing Director Naomi Ganoe learned about the benefits of gifting a life insurance policy to charity. As someone with a longtime passion for giving back to the causes she cares about, Naomi was drawn to the simplicity and effectiveness of this giving vehicle.

"After seeing the illustrations, I realized that life insurance is one of those easy ways to make a significant gift," she said. "It made a lot of sense to me."

Naomi soon put that strategy into action and secured life insurance policies that will benefit two of her favorite charities. One policy will support behavioral health at Summa Health, and the other will benefit her donor-advised fund at Akron Community Foundation.

"I'm at that age where I'm young enough and healthy enough to qualify for a new policy," she said. "I'm also at the point in my career where I appreciate the charitable deduction I receive for the premiums."

By naming Akron Community Foundation as the owner and beneficiary of the new policy, Naomi is able to make tax-deductible gifts to the foundation to pay the premiums. After her lifetime, Naomi's donor-advised fund will receive the full amount of the insurance benefit, and her daughter, Cassie, will be able to follow Naomi's example and continue both of their legacies of giving by making grants from the fund to charities they both care about.

"I get a tax write-off now for something my daughter will be able to give away later," Naomi said.

Naomi's decision to name her donor-advised fund as the beneficiary of the gift allows Naomi to continue to pass her charitable values on to her daughter while retaining the flexibility to support a variety of causes in the future if interests or community needs change.

In addition, Naomi was able to structure the policy so it would be paid in full by the time she turns 60, ensuring that she won't have to worry about paying the premiums during retirement.

"If I retire or go part time, I would prefer not to have the premium expense, so we crafted the policy to fit my needs and my situation," she said.

Naomi noted that some donors may also choose to pay for their policy with a single lump-sum gift. This can be an ideal option for someone with a recent liquidity event or high-income year. Depending on the person's health, it's possible to secure a high-value policy for a relatively low upfront cost, thereby amplifying the power of their gift.

The question to ask, said Naomi, is: "Would you be willing to part with $50,000 now for a $250,000 charitable impact at death? Everyone's situation is different. Also, the $50,000 in premiums is actually less after tax."

For Angelina Milo, who serves as the vice president of tax services at Meaden & Moore, the benefits of gifting a life insurance policy are clear.

A decade ago, while serving on the advisory board of the Women's Endowment Fund of Akron Community Foundation, Angelina made a gift of life insurance to support the fund's "For Women, Forever" 20th anniversary campaign.

"I wanted to make a large contribution, but at that time I had other expenses, such as my kids' private school," Angelina said. "This was a great way for me to combine estate planning and income tax planning early in my career."

Angelina secured a $50,000 life insurance policy with premiums of just $500 per year. Like Naomi, she transferred ownership of the policy to Akron Community Foundation and received a charitable deduction for the annual premium payments. After Angelina's lifetime, the Women's Endowment Fund will use her generous gift to uplift and empower future generations of women and girls in Summit County.

"I knew my charity of choice was the Women's Endowment Fund, so I wanted to make a significant contribution now, while I'm living," she explained.

Another key benefit, Angelina said, is that her life insurance policy is separate from the rest of her estate assets.

"It's not as if I need to carve out $50,000 of my wealth; I'm actually creating that wealth by donating the life insurance outside of my estate," she said. "I can still leave my estate assets to my family in addition to making other charitable contributions from my estate later in life."

Did You Know?

Donors like Naomi and Angelina who gift a life insurance policy to a fund at Akron Community Foundation are welcomed into the Edwin C. Shaw Society, a special legacy group that celebrates those who have named the foundation in a planned gift.

Both Angelina and Naomi noted that gifts of life insurance are most beneficial for donors who:

- Are in good health and can qualify for affordable premiums

- Have reached their high-income-earning years and need a charitable tax deduction

In order to secure the policy, donors have to complete a physical exam and also demonstrate to the insurance company that they have a track record of supporting the named charity. "There has to be a pattern of past giving," Naomi explained.

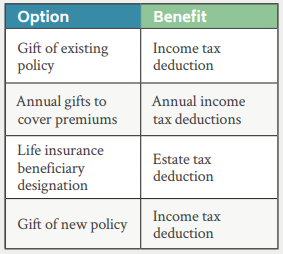

In addition to gifting new life insurance policies, donors also have the option of transferring ownership of an existing policy to charity. These gifts can be more complex because they require a policy valuation, so it's key for the donor to work with their advisors prior to initiating the transfer.

In either scenario, gifts of life insurance are often a win-win strategy for both the donor and the community, Naomi and Angelina said.

"I learned a long time ago from a client who was selling his business that it's important to give back to the community where you earned your wealth," Naomi said. "This is one way that I can do that."

For more information about gifts of life insurance, contact Laura Lederer. We're always available to answer your questions about philanthropy or to schedule a personal consultation – all at no cost.

Additional Resources

Getting Started: 5 Tips for Advisors

Before you assist your client with a gift of life insurance to a charity, here are five pointers:

- Check state law first. Most – but not all – states allow transfers of life insurance policies to a charity.

- Request change of ownership and change of beneficiary forms from the insurance company, and make sure you have the right forms. The paperwork is not always user-friendly. There are instances where a donor completes the wrong set of forms and thus fails to accomplish the intended transfer. The charity will need to be the policy owner and, unless the charity intends to surrender the policy, also be the named beneficiary.

- Carefully calculate the charitable income tax deduction for the gift of the life insurance policy to the charity. The taxpayer is eligible for a deduction equal to the lesser of the policy's value or the taxpayer's basis (usually the total amount of premiums paid). The value of the policy is computed using the replacement cost or the "interpolated terminal reserve" plus unearned premiums.

- Be sure to check for loans against the policy to avoid an income tax event for the taxpayer.

- Finally, do not run afoul of the "insurable interest" rules, which can come into play when the charitable entity pays the premium on a life insurance policy transferred to or secured by the charity on your client's life.

This content is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.