Congress extends charitable giving incentives for 2021

A wild ride in 2020 ended with the extension of several tax provisions to encourage charitable giving in the midst of ongoing pandemic-related challenges facing nonprofits. As your clients evaluate their approach for 2021, now is a great time to address their charitable giving plans for the coming year.

We've seen that COVID-19 has proven to be a marathon, not a sprint. Nonprofit organizations will be relying on the generosity of donors for the foreseeable future to stay afloat and serve the people who need their programs.

Consider dropping a quick note to clients for whom philanthropy is a priority, sharing a few tips that can help make 2021 a better year for our community:

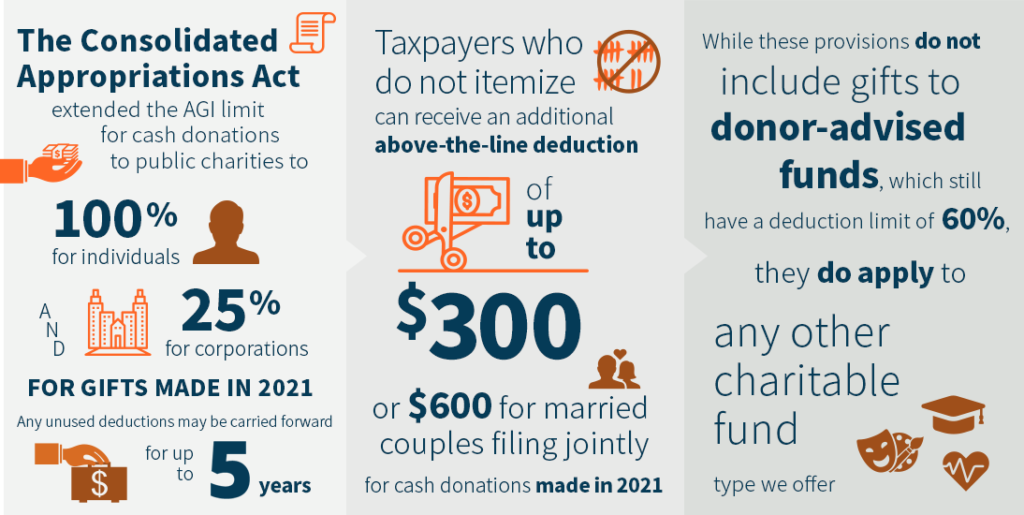

- Even non-itemizers should plan to make at least $300 in cash contributions to qualifying charities (and now $600 for non-itemizing joint filers) this year. The Coronavirus Stimulus 2.0 bill, which was signed into law in December, extends the CARES Act's temporary, above-the-line charitable deduction for contributions to qualifying public charities for tax year 2021.

- The Coronavirus Stimulus 2.0 bill also includes a one-year extension of the CARES Act's provision increasing charitable deduction limits to 100% of AGI for contributions by individuals to qualifying charities. This creates an opportunity to work with your clients on a charitable giving budget for 2021, especially because you'll want to run calculations to determine whether clients can benefit from this incentive, or whether a client would still be better off carrying forward charitable contribution deductions into future years.

- Given the extensions included in the Coronavirus Stimulus 2.0 bill, coupled with the general uncertainty about potential tax reforms under the Biden administration, it is wise to counsel your clients about being especially organized about charitable giving in 2021. Clients will want to be even more conscientious about the impact of dollars invested in the community, too.

While the provisions outlined above do not include gifts to donor-advised funds, they do apply to all other charitable fund types Akron Community Foundation offers, including designated, scholarship and field-of-interest funds.

To learn more, contact Laura Lederer at 330-436-5611 or llederer@akroncf.org. We're always available to answer your questions about philanthropy or to schedule a personal consultation with you and your clients – all at no cost.

Additional Resources

This content is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.